How Companies are Pursuing and Acquiring Water to Power Colorado

In July 2012, the city of Aurora stopped negotiating. They had exchanged their last term sheet, and the city council voted eight to three in favor of striking a deal—the Anadarko Petroleum Corporation could lease water from Aurora for five years, with an option to extend for another five.

Suddenly the Front Range was buzzing with news of the lease. Some papers ran just the facts: Anadarko would pay the city a healthy $9.5 million total, or $1,200 per acre foot of water, receiving 1,500 acre feet each year. Other stories featured the emotional side—the worries and upset of citizens.

“We were surprised at the response, because, when you stripped off the uses of water, it seemed like a normal deal with many of the same elements as before,” says Lisa Darling, Aurora Water’s program manager for the South Platte River Basin, who negotiated the deal.

It was normal, in that Aurora leased some of its excess water supply—a customary practice for the city. But the end-user here, Anadarko, will employ the water in oil and gas development, using it for drilling and hydraulic fracturing in Weld County. This was new for Aurora.

Recent years have heralded other negotiations that link water rights holders to energy or power companies, with varying outcomes. Both energy companies, which extract natural gas, oil, coal, uranium or other energy-producing minerals, and power companies, which use those fuels or renewable sources to generate electricity, require water for their operations, which in Colorado means access, in some form or another, to a water right.

Water rights for energy are nothing new. In fact, Colorado’s prior appropriation system, commonly summed up as “first in time, first in right,” is rooted in early hardrock mining, where it was first applied. This system, now administered across all “beneficial uses” of water in the state, allows for those with older, senior rights to use water before those who hold newer, more junior rights in times of shortage. Although power plants have been around for decades with water rights of their own, their water supply portfolios are changing, while oil, natural gas and coalbed methane production has been growing in a fast, new fashion. All require water.

Still, the numbers seem small. As of 2011, according to the Colorado Water Conservation Board and Division of Water Resources, an estimated 0.47 percent of the state’s current water withdrawals went to thermoelectric power generation; 0.03 percent to coal, natural gas, uranium and solar development; and 0.04 percent to hydraulic fracturing. Compare that to the 86 percent that goes toward agriculture and 8 percent to municipal and industrial uses, and energy’s share looks insignificant.

But in a water-short state, where most supplies are already allocated, many players are competing for the same water, and new uses are being closely scrutinized. Fierce competition can also drive up costs, excluding some from the marketplace. And while water needs for power remain fairly consistent, some say there isn’t enough data to truly account for the energy industry’s water demands as comprehensive statewide water resource planning unfolds.

Tracy Kosloff. Photo By: Kevin Moloney

“Municipalities have a lot of freedom to lease water to oil and gas or other kinds of users.” – Tracy Kosloff, Colorado Division of Water Resources

“It’s sort of a moving target at this point because things are changing so fast,” says Laura Belanger, a water resources engineer with Western Resource Advocates. Belanger’s group estimates that if oil and gas development continues at a rate similar to the present, water needs for Colorado’s new oil and gas wells alone will range from 22,100 to 39,500 acre feet annually by 2015. That equals the water needs of up to 79,000 Colorado households for a year, but results in the production of all the natural gas used in the state—and then some.

Water for Energy

Just like any other water user looking to access the resource, energy companies have options. Although new energy developers likely don’t own the most senior water rights, they can apply for new junior rights, or can acquire and change a senior right, legally altering its use. The Colorado Division of Water Resources is involved in such change cases, like any other, to make sure the final outcome doesn’t affect other senior water users’ ability to obtain their allotted water.

Leases such as the Anadarko-Aurora deal are a better short-term option and require less legal oversight than purchasing, changing and owning a water right. “Municipalities have a lot of freedom to lease water to oil and gas or other kinds of users,” says Tracy Kosloff, water resources engineer with the Division of Water Resources. Kosloff works on well permits as well as temporary and permanent changes of water rights from their original use to new uses. In the case of a lease, the municipality or other leaser, such as an agricultural user, owns the water right and has to divert, obtain and account for the water in accordance with their legal decree. The contract is between the water rights holder and the lessee. “Basically [the municipality is] providing water to a customer within their service area,” says Kosloff.

Aurora, for instance, plans its water supply to ensure there is enough during drought and for projected growth. The city secures water when it’s available and leases the excess until it’s needed years down the road. The water Anadarko leased is a small portion of the city’s excess—in this case, treated wastewater the city would otherwise be entitled to reuse if the infrastructure were in place to do so.

Drilling a well to pump groundwater or entering an agreement with a well owner is also possible, though the majority of wells withdraw tributary groundwater, which is water connected underground to surface streams. To protect senior water users in the system, these wells require an augmentation plan for replacing depletions that would have otherwise reached the river. Well users must somehow acquire or purchase that replacement water from another source.

Nontributary groundwater, however, is not connected to a stream system and can be used without augmentation—a preferable arrangement for an energy company. Permitting for nontributary wells is based on the estimated amount of water contained beneath that land’s surface area—and limited to a withdrawal rate of 1 percent per year assuming a 100-year life of the aquifer. The Division of Water Resources has seen a recent increase in nontributary determination applications: There were two filed in 2010 and zero in 2011. That jumped to five filed in 2012 and six that reached Kosloff’s office in the first eight months of 2013. This nontributary water is often so far beneath the surface that it’s not cost-effective for other, nonenergy users to access, says Kosloff.

Local Leasing Decisions

Leasing water rights is an attractive option for energy companies, who typically have shorter-term demands for water compared to power companies. Water is used to drill and possibly hydraulically fracture a well, but isn’t necessarily required for ongoing production, although sometimes wells are fracked multiple times over their productive life.

Lisa Darling. Photo By: Kevin Moloney

“When we first began negotiating, we were surprised to find that the [oil and gas] parties were willing to talk about rates that were typically three or four times more than where the market had been previously.” – Lisa Darling, Aurora Water

For municipalities, the attraction of leasing arrangements is usually financial—oil and gas companies have money and are willing to pay. Aurora charged Anadarko four times their usual excess water lease rate of $300 per acre foot. Now the rate has risen even higher. “When we first began negotiating, we were surprised to find that the [oil and gas] parties were willing to talk about rates that were typically three or four times more than where the market had been previously,” Darling says. “Now we hear the price has escalated even further. Obviously, the water lease market is in a state of great flux.”

Other towns are also leasing excess water supplies, particularly those closest to Weld County, where the majority of the state’s current drilling activity is centered. And many towns that receive Colorado-Big Thompson Project water from the Northern Colorado Water Conservancy District are leasing excess water when it’s available as well. Erie, Fort Lupton, Greeley and Longmont have reaped big benefits and, in some cases, are paying down debt with the leasing revenues. Residents see the benefit coming back to them through lower water rates. Aurora, for example, completed its $680 million bond-financed Prairie Waters Project in 2010, but residents have seen no increase in rates over the past few years, in part due to the Anadarko lease.

Still, other municipalities are closely guarding their water. In June 2012, the town of Windsor decided to take a step back from leasing large quantities of water to oil and gas development. The town had just begun leasing water in November 2011, but the rush of demand was higher than expected and more than local leaders were comfortable supplying. Windsor sold 8.4 million gallons—nearly 26 acre feet—of water to six oil and gas well servicing companies between November 1, 2011, and March 1, 2012, bringing in more than $16,800. But by June, the city council had approved an ordinance to restrict the volume of water used at hydrants—where trucks bound for drilling sites were filling up—and to raise the rate for large users.

Suzanne Jones. Photo By: Kevin Moloney

“We would rather use this valued and limited resource, [water], to support our people in growing food and maintaining healthy rivers and landscapes.” – Suzanne Jones, Boulder City Council

Doug Flanders, director of policy and external affairs for the Colorado Oil and Gas Association, doesn’t mind a city’s decision to limit sales—he sees that as no different from a watering restriction— but he worries about completely prohibiting water sales for hydraulic fracturing. “When you prohibit something, is that a discriminatory business practice?” he asks. “We will sell you this, but not this; they can buy it, but not you; they can drive my road, but you can’t. Can they do that? I don’t know.”

Boulder is currently testing those limits. In June 2013, the Boulder City Council unanimously passed an ordinance prohibiting the use or sale of Boulder’s water supply for hydraulic fracturing. “We would rather use this valued and limited resource, [water], to support our people in growing food and maintaining healthy rivers and landscapes…We don’t want to be selling our water to support something that we’re not sure should be happening,” says City Councilwoman Suzanne Jones.

Although other municipalities have recently made similar decisions to restrict hydraulic fracturing within their borders, Boulder is Colorado’s only city so far to specifically prohibit water use for the practice. In fact, Boulder isn’t sure that nonrenewable energy development should be happening in any form. The city has decided not to renew its contract with Xcel, in part due to failed negotiations over adding more renewables to its energy portfolio, and is now in the process of forming its own municipal utility. “We think it’s really important to try to decarbonize our supply in the face of climate change,” Jones says. “We are very interested in getting off fossil fuels as quickly as possible while maintaining our robust economy and fuel prices.”

Some leaders in Boulder are also concerned about the availability of water rights for farmers, worrying that farmers are being outbid, Jones says. During periods of drought, this is more of a concern because of heightened competition. Although farmers who hold senior irrigation water rights aren’t typically bidding against the energy industry, others rely partially or completely on purchasing excess supplies.

Nick Colglazier of the Colorado Farm Bureau says his organization supports Colorado’s market-based system, where water rights are treated as property rights that can be bought, sold, leased and transferred between any willing buyer and seller. “This [bidding up of prices] does ruffle some feathers in the ag community since water is a scarce resource,” he acknowledges. “Some farmers do depend on leasing water from cities and this competition makes it harder and more expensive to acquire.” But, he adds, while the bidding power inequity between players in the marketplace is likely to be an ongoing conversation, “Most of the voices you hear complaining about oil and gas taking ag water are those outright opposed to the process of hydraulic fracturing.”

Water for Power

Electrical companies and power generators haven’t been paying quite the same premium for their water. Rather, they pay a middle-tier rate for their leases and purchases based on the term of the lease (usually long), the volume of water taken (typically large), and likely because most of their leases were contracted before there was competition with the energy industry.

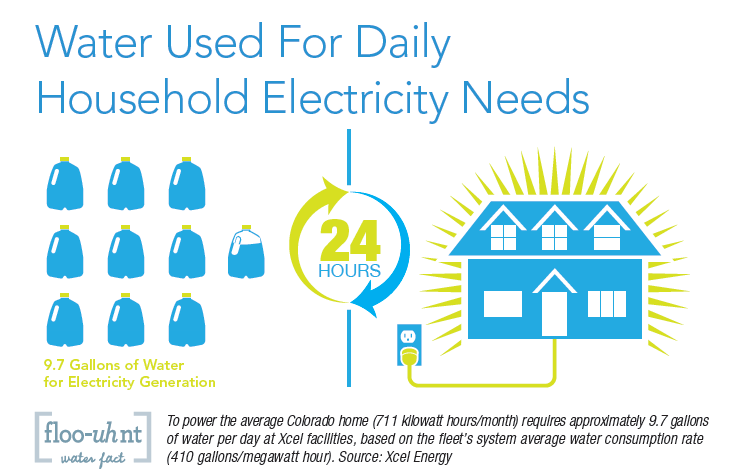

In the case of thermoelectric generation, where the majority of Colorado power comes from, water is critical for cooling and condensing steam in generating stations. Large quantities of water are required—and an average of 90 percent of water sourced statewide for thermoelectric power production is completely used up in the process. Still, the share of water going to meet the daily electricity needs of the typical Colorado residence roughly equates to taking a three-minute shower, says Rich Belt, water resources analyst with Xcel Energy.

Power generation is a more visible and con-stant use of water than energy extraction. A company simply can’t let the power go out because of a drought or other interference, and so Xcel Energy and others have worked to diversify their water portfolios.

“It’s kind of like the advice you might get from a money manager if you buy a mutual fund: You’re diversifying your risk if you don’t have all your eggs in one basket,” Belt explains. Xcel has what Belt refers to as a “bundle of sticks” approach—different sources of water in each of Colorado’s seven water divisions statewide, including transferred rights, leases, junior rights, storage—plus the ability to legally move water up and down rivers, in effect tying together supplies for all of Xcel’s thermoelectric power plants within a river basin.

This dedication to resiliency has meant more cooperative projects among water users. In Sterling, Xcel entered an agreement with the Point of Rocks Water Company to hedge against an unforeseen or catastrophic event or drought. Now, if Xcel calls for water, Point of Rocks will deliver that water out of its reservoir, reducing the amount available to irrigators. This ensures Xcel has an adequate water supply to operate its nearby Pawnee Station, even in drought years, Belt says. In exchange, Xcel pays Point of Rocks an annual fee, and if it were to exercise the agreement, Xcel would pay per acre foot of water delivered. That extra money could, in turn, help Point of Rocks irrigators through dry times when crop yields suffer.

Another agreement is benefitting Tri-State Generation and Transmission Association—and the Yampa River. In 2012, the Colorado Water Trust began Colorado’s first temporary water leasing program to wet dry riverbeds during the summer’s drought. The Upper Yampa Water Conservancy District approached the nonprofit with 4,000 acre feet of water they were willing to sell to the program, but with the condition that the leased water be put back into another form of beneficial use. Tri-State jumped on board to use the water for electrical generation downstream.

Throughout summer 2012, the leased water rushed out of Stagecoach Reservoir, providing a constant flow to boost the Yampa. From Stagecoach to Lake Catamount, that water was protected by an instream flow water right, but the Colorado Water Trust wanted to move that water beyond the protected reach through the town of Steamboat where people enjoy tubing and fishing—unless flows are low, as they were early that summer. Tri-State’s participation in the agreement ensured the water would be shepherded through Steamboat all the way to Tri-State’s coal-fired power plant in Craig. The lease was repeated, but structured differently, during 2013’s summer months.

As water resources analyst with Xcel Energy, Rich Belt manages planning, operations, legal and legislative tasks related to the company’s water needs. Photo By: Matthew Staver

Water use for energy and power is only going to increase over coming decades, according to state and industry projections, but conservation and recycling lessen the demand. In Longmont and a few other locations, Xcel trades water, exchanging fresh mountain Colorado-Big Thompson Project units for an equal amount of wastewater effluent. “It keeps [Longmont’s] treatment cost down. It’s obviously better water for their users and the wastewater effluent is fine for us,” Belt says. The future for Xcel looks like more natural gas plants and renewables such as wind and solar—which should translate to decreased water use.

For oil and gas, recycling and reuse of water are improving. On the Western Slope, Encana recycles more than 95 percent of water used for or produced during drilling—this waste water cycles through the company’s four water treatment plants and is piped through a 300-mile network of pipelines to reach wells where it’s reused for hydraulic fracturing. Each barrel of water is reused an average of 1.33 times before disposal, says Encana spokesman Doug Hock.

“Everybody talks about what can we [the oil and gas industry] do to save water, and we’re doing it,” says Flanders. “We’re becoming more efficient with our water, we’re recycling more water, we’re doing everything.”

Others say the industry could still do better, arguing that the state’s current deep well injection rate of 51 percent of contaminated drilling waste fluids removes a substantial amount of water entirely from the water cycle.

Belanger believes the energy industry is trying to recycle wherever possible. Still she calls for more data on what demands for energy and power will look like in the future—and better incorporation of this information into water supply planning. She points to the 2010 Statewide Water Supply Initiative, which includes an oil and gas section but lists no energy demands for the South Platte Basin. “For some reason [oil and gas development] took off so fast, we just missed it in the last round of SWSI planning,” Belanger says. “As we look forward and plan and figure out how to meet urban, agricultural and environmental water needs, we need to make sure [water demands for energy] are considered.”

The Colorado and Yampa/White basin roundtables attempted to fill the data gap several years ago by commissioning an Energy Development Water Needs Assessment for northwestern Colorado. Of particular interest were the extensive potential needs associated with oil shale development, which seemed poised to take off. The study found that overall long-term energy-related water demands for the basins range from 5,705 acre feet to 151,730 acre feet per year—the range due to the uncertainty of oil shale, which alone could require up to 120,000 acre feet per year. With oil shale development currently stalled in the face of the natural gas boom, the energy demands in Colorado’s northwest corner are far more modest.

“It [energy’s water demand] is big, but it is not insurmountable,” says Dan Birch, deputy general manager with the Colorado River District and energy subcommittee co-chair for the two roundtables. “If energy development is going to occur, it’s going to occur and water is not going to be a limiting factor for it.” But, he adds, “We want to make sure those demands are folded into the planning process that’s underway right now so they’re not forgotten.”

In May, Gov. John Hickenlooper issued an executive order that the Colorado Water Conservation Board commence work on a state water plan, complete a draft by December 10, 2014, and finalize the plan by December 10, 2015. Among other things, the governor’s order asks that the plan emphasize projects that stress conservation, innovation and collaboration—a sound directive.

Fortunately, Colorado is already seeing some such projects. From plans that prepare regions to integrate oil and gas development with other water demands, agreements ensuring that each drop of water sees many uses, and win-win water exchanges, cooperation is a form of friendly etiquette—born of necessity. The sooner Colorado can manage water in ways that work for everyone, says Darling, the sooner we can become more successful as a state.

Print

Print